Guaranteed 9250 rupees income from this Post Office scheme for 5 years and learn a trick to earn 17 Lakhs to 35 lakhs rupees . Click to know full details on the investment and return

Guaranteed 9250 rupees income from this Post Office scheme for 5 years and learn a trick to earn 17 lakhs to 35 lakhs rupees. We will know full details on the investment and return

Hello Friends. We are again with so much exciting blog, which will enable you to get over 9000 rupees every month into your savings account.

As you know there are several amazing plans or schemes available and even with Indian post. Indian Post has the biggest network and reach to even the smallest and interior village in our country. This means that a person from any part of India can invest in the plan which other financial educated people are investing in urban cities. As a matured person, it is important to invest wisely in order to grow our money and also secure the future of ourselves and our loved ones simultaneously.

From all those amazing plans, we will pick a scheme or investment option and discuss today about that to get more details about the investment, benefits, features and return and we will learn why it is a smart investment choice.

So, what is the plan?

So, we are today going to pick the Monthly Income Scheme (MIS) offered by the Post Office which is a government-backed investment scheme.

It is one of the lowest risk investment options that provides a fixed monthly income to investors.

The scheme has a maturity period of 5 years, and the interest rate is currently set at 7.4% per annum payable monthly. Minimum investment amount for opening of account is 1000 rupees and Maximum investment limit is 9 lakh rupees in single individual account and 15 lakh rupees in joint account

An individual can invest maximum INR 9 lakh in MIS (including his share in joint accounts). For calculation of share of an individual in joint account, each joint holder have equal share in each joint account.

Benefits:

- One of the key benefits of the MIS is its guaranteed returns. Unlike other investment options that are subject to market fluctuations, the MIS offers a fixed rate of interest that is not affected by market conditions. One of the main advantages/benefits of the MIS is its reliable and guaranteed returns. Not at all like other options that are dependent on market fluctuations, the MIS offers a decent pace of revenue that isn't impacted by economic situations.

This majorly makes the MIS to be an attractive option for the investors who want to part their money and get guaranteed returns regardless of the market fluctuations which ultimately brings investment stability.

- Next benefit is liquidity. Let me explain this to you. As human beings, we would like to invest and grow our wealth, but we also can have urgent scenarios or any sort of emergencies where we want our money to be withdrawn. Many investment options have a tight lock-in where we cannot withdraw our amount, but since this has liquidity feature, we can withdraw our invested amount at any point of time before maturity, but subject to a penalty.

The clauses are:

(i) No deposit shall be withdrawn before the expiry of 1 year from the date of deposit.

(ii) If account is closed after 1 year and before 3 year from the date of account opening, a deduction equal to 2% from the principal will be deducted and remaining amount will be paid.

(iii) If account closed after 3 year and before 5 year from the date of account opening, a deduction equal to 1% from the principal will be deducted and remaining amount will be paid.

(iv) Account can be prematurely closed by submitting prescribed application form with pass book at concerned Post Office.

Since the name is monthly scheme, let's understand how are we going to get 9250 rupees every month.

Earning Process:

Let's say we have 15 lakhs as extra amount which I want to keep secured. Possibly I can use amount for my child's higher education after 5 years. So, obviously I may not invest that in Stocks or Mutual funds, since there is a risks attached to it. Like we discussed in our previous blog, how good is to invest in mutual funds and how much risk is associated, we knew that these options should be for long term, not for short term. If you have not gone through that blog, you can visit this:

Now, we have to go to the secured and save investment options and we have to earn also till the time this money is actually utilised. So, I will select MIS. Me and my wife will visit the Post Office and will create a joint account and will have our kid as the nominee. Next we will open an MIS by investing 7.5 lakhs and 7.5 lakhs each (total 15 lakhs).

After that, interest shall be payable on completion of a month from the date of opening and so on till maturity to us. Interest can be drawn through auto credit into savings account of the same post office, or ECS. In case of MIS account is opened at CBS Post offices, monthly interest can be credited into savings account of any CBS Post Offices. This means we would get the interest money credited to our account every month else such interest shall not earn any additional interest kept in MIS account and not claimed.

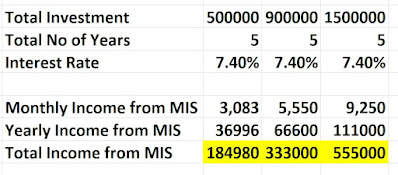

By investing 15 lakhs rupees, we will get 9250 rupees every month at the 7.4% interest rate, meaning 110000 rupees yearly and 555000 rupees total interest. Isn't amazing? If we would have kept this much of money in a Bank Savings account, then we would get 3750 to 4375 rupees per month and yearly 45000 rupees to 52500 rupees. Meaning 225000 rupees to 262,500 in total 5 years.

MIS Table Summary:

How to Earn 17 Lakhs to 35 lakhs

To earn 17 Lakhs to 35 lakhs, one hack you have to do. You are getting this 9250 rupees as free interest money every month. Why not invest at least 500 rupees from that money in SIP mutual fund. Meaning I am asking you to start an SIP and invest only 500 rupees every month out of 9250 rupees.

Scenario#1

In 5 years, your MIS will mature but You keep on investing only 500 rupees for next 30 years for yourself and retirement. 500 rupees out of 9250 rupees won't cost you much.

When you do that, do you know how much money that would have accumulated in 30 years?

You would have invested totally ₹1,80,000 over the 30 years, but that will have become total ₹35,04,910 rupees with interest as ₹33,24,910 rupees when considering the expected return rate is 15% which is possible from a Mutual Fund.

We can at least expect 12% rate of return minimum from a Nifty 50 Index Direct Mutual Fund, which means our total 1.8 Lakhs in 30 years of investment would have become ₹17,64,957 rupees with interest amount as ₹15,84,957.

See, you didn't have to do anything, nothing from your pocket, rather your MIS has given you the interest and a small chunk of that interest will fetch you 17 to 35 lakhs of rupees.

SIP Table:

Scenario #2

Let's say you are an early investor (20-25 years) and you don't have 15 lakhs rupees. You have only 5 lakhs rupees and you want to secure and grow this. When you invest in MIS, it will give you 3,083 every month and by end of 5 years you would have got totally 184980 rupees as interest amount.

You start an SIP of only 500 rupees after your first interest income from MIS and don't touch that interest amount for next 30-40 years.

You will see you would have accumulated total ₹17,64,957 rupees in 30 years and ₹59,41,210 rupees in 40 years with minimum 12% as Mutual fund interest rate.

If you get 15% as rate of interest, then you would have accumulated ₹35,04,910 rupees in 30 years and ₹1,57,01,878 (Over 1 Crore 57 Lakhs) rupees.

This is an amount which you will get from the free interest amount received from MIS. You can play around with any SIP calculator available online to check.

I have given you a superb Jugaad/idea to secure your capital/grow safely along with this a mantra for becoming rich.

Now, question is who can open the MIS account?

(i) If you a single adult

(ii) You can open with a Joint Account (up to 3 adults) (Joint A or Joint B))

(iii) If you are a guardian on behalf of minor/ person of unsound mind

(iv) If you are a minor above 10 years in his own name.

One more thing, your Interest is taxable, but there is no TDS deduction on the interest.

This means that investors can claim deductions on the interest earned under Section 80TTB of the Income Tax Act, up to a maximum of Rs. 50,000 for senior citizens.

How is the Maturity process of MIS?

(i) Account may be closed on expiry of 5 years from the date of opening by submitting prescribed application form with pass book at concerned Post Office.(ii) In case the account holder dies before the maturity, the account may be closed and amount will be refunded to nominee/legal heirs. Interest will be paid up to the preceding month, in which refund is made.

Investing in the MIS is a simple and hassle-free process. Investors can visit their nearest post office and fill out the application form, along with the necessary KYC documents. The investment can be made through cash, cheque, or demand draft.

People search these below topics in Internet for MIS Scheme. Hope you got all the details about MIS:

post office monthly income scheme

post office monthly income scheme calculator

post office monthly income scheme for senior citizens

post office monthly income scheme interest rate 2022

senior citizen post office monthly income scheme calculator

post office monthly income scheme interest rate 2021

post office monthly income scheme calculator 2022

post office monthly income scheme 2021

post office monthly income scheme eligibility

post office monthly income scheme latest interest rate

post office monthly income scheme 2023

post office monthly income scheme calculator 2023

Post a Comment